loans worth £17.3 million disbursed by 132 MFI branches

Introduction

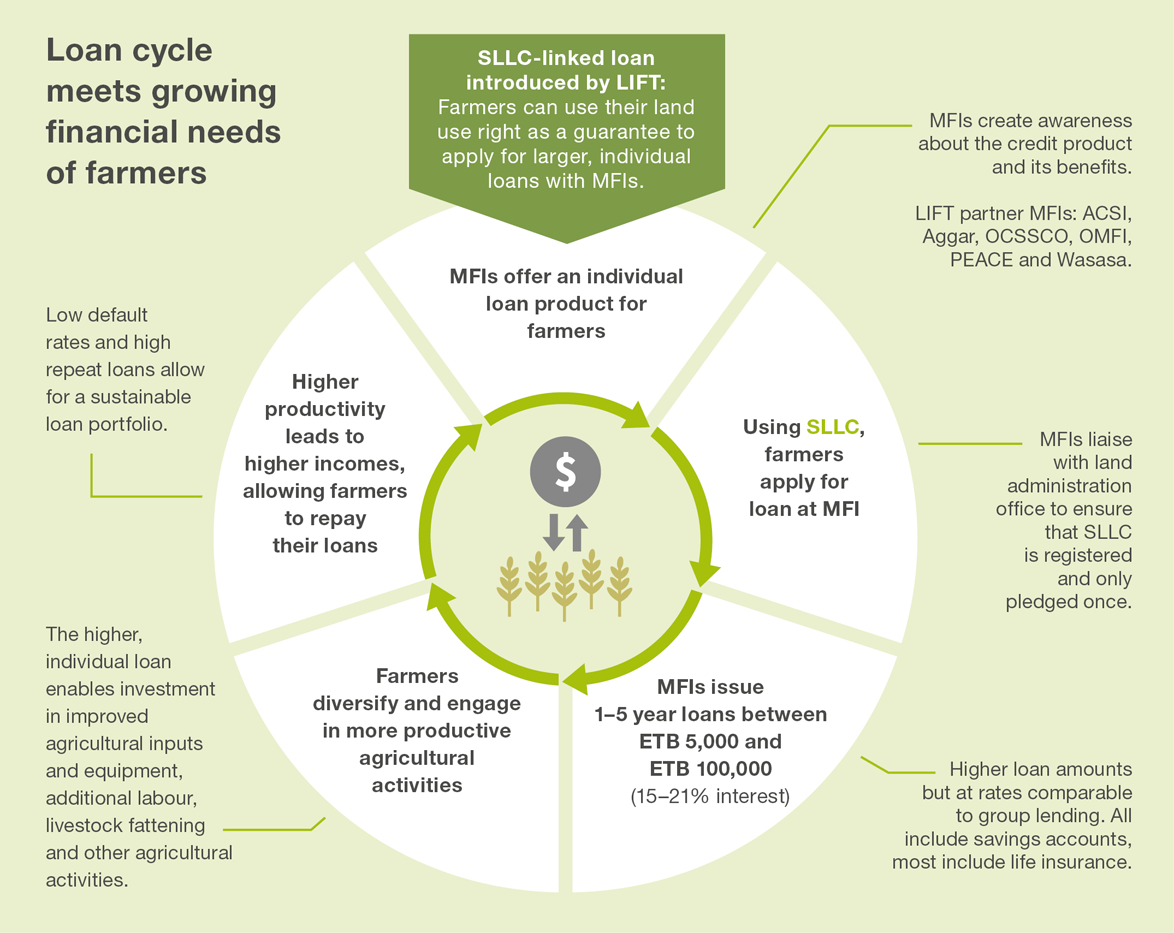

Access to finance is key to landholders being able to invest in improved agricultural inputs to increase their agricultural production. Until recently, rural farmers could only access group loans as they lacked fixed assets to use as a guarantee. The drawbacks to group loans are that the value is low, which limits the scale of investment borrowers can make, and the compulsory saving element requires all members to repay before being able to access their accrued savings.

To address the limitations of the group lending system, LIFT, in partnership with microfinance institutions (MFIs), developed an individual loan product linked to second level land certification that used the produce of the land as a form of guarantee, to give certificate holders the option to choose between a group loan or an individual loan.

With second level land certification, MFIs have the security of knowing the legal landholder and exact landholding size of farmers, who can borrow more (between ETB 5,000 and 100,000) than they were previously able to under group loans. Farmers have more flexibility to decide what to invest in and what the loan repayment terms are, and can have their applications assessed based on the merits of their business plans, rather than on how long they have been MFI customers.

What is the loan used for?

The loan can be used for agriculture-related productive purposes such as buying improved seeds and fertilisers; paying for additional labour; renting or buying oxen to plough; livestock fattening; purchasing irrigation equipment to engage in growing high-value crops; and other income-generating activities.

This has enabled rural farmers in Ethiopia to go beyond income smoothing, allowing them to use their land more efficiently and effectively or diversify their economic activities into alternative production systems, which will result in an increase in incomes.

What are the benefits of the SLLC-linked loan product?

Opportunities for smallholder farmers to move up the productivity chain:

- Smallholder farmers gain access to larger and longer-term loans, which allows them to graduate from subsistence farming.

- Smallholder farmers can increase their productivity, diversify their investments and increase their incomes.

MFIs complement existing group lending products and reach new customers:

- MFIs can now reach smallholder farmers who previously were not accessing finance due to the risks of group lending and whose needs were not being met by existing MFI products in terms of loan size and duration.

Adaptability of the loan product to individual needs:

- The product gives flexibility as smallholder farmers decide what size of loan they want, when to repay and the kind of business they want to engage in.

- The application process is faster than for group lending as clients do not depend on other group members being present for decision-making.

Inclusiveness:

- The loan product allows MFIs to assess the merits of each application individually, as long as the applicant’s business plan is viable and they have the SLLC.

- The loan product requires that both the husband and wife are involved in the application process, to ensure they are both aware and informed about the process and expectations, and both are required to sign the loan agreement.

- Vulnerable groups such as the elderly and female-headed households, who are often excluded from group lending schemes as they are considered too great a risk of default by their peers, are now able to access finance for the first time.